long island tax rate

Long Island Tax Accounting Advisory Services Inc. High Taxes in Long Island New York reduce property taxes.

How Do State And Local Sales Taxes Work Tax Policy Center

I would refer to Newsday major metro NYC newspaper founded on Long Island for their average Nassau County tax rate chart for 2016.

. The minimum combined 2022 sales tax rate for Nassau County New York is. Usually it includes rentals lodging consumer purchases sales etc For more information please have a look at Alaskas Official Site More About Long Island Coordinates. Keep this information in mind while determining which county of Long Island will serve your needs the best.

The New York sales tax rate is currently. The minimum combined 2022 sales tax rate for Long Island City New York is. This is the total of state and county sales tax rates.

The sales tax rate on Long Island is the highest in. 157 rows Average real estate tax 1062715. How to Challenge Your Assessment.

How much are taxes in Long Island. The 2022 state personal income tax brackets are updated from the New York and Tax Foundation data. Long Island school districts 2016-17 tax plans I grew up in.

In 2018 the average millage rate in the county was 264 mills which would mean annual taxes of 7920 on a 300000 home. Also Nassau Suffolk counties. Answer 1 of 2.

Note that this also includes the price needed for school property taxes. There is no applicable city tax or special tax. 4 rows Currently the sales tax rate in Long Island City is 8875 percent.

The Long Island City sales tax rate is. For tax rates in other cities see Kansas sales taxes by city and county. Our clients can always contact us at our Roslyn Long Island office for.

Rules of Procedure PDF Information for Property Owners. The 2018 United States Supreme Court decision in South Dakota v. 4 rows Long Island City NY Sales Tax Rate.

Average SALT deductions 1758097. Queens and Brooklyn have better options but towns further into Long. 412022 10022 PM.

Suffolk County collects on average 17 of a propertys assessed fair market value as property tax. But under Bidens tax plan individual long-term gains would increase from a 20 rate to a maximum rate of 396 on ordinary income. 9 Things You Should Know About The New Tax Plan Biden tax plan and real estate.

The median property tax in Suffolk County New York is 7192 per year for a home worth the median value of 424200. You would pay capital gains on that 300000 increase in property value at a 20 tax rate. Suffolk County has one of the highest median property taxes in the United States and is ranked 12th of the 3143 counties in.

The Nassau County sales tax rate is. You can print a 7 sales tax table here. Live on Long Island.

The County sales tax rate is. The current total local sales tax rate in Long Island. Returns with SALT deductions 7200.

Among the many different counties of New York Suffolk and Nassau counties on Long Island have some of the highest property tax rates both over 2. However effective tax rates in the county are actually somewhat lower than that. Has impacted many state nexus laws and sales tax collection requirements.

In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7 The Sales tax rates may differ depending on the type of purchase. Lenny Bottiglieri Office -. Total SALT deductions In thousands 126583.

Menu Skip to content. Nassau County Tax Lien Sale. The average effective tax rate is approximately 211 which means taxes on that same home are likely closer to 6330 annually.

The New York state sales tax rate is currently. New York tax forms are sourced from the New York income tax forms page and are updated on a yearly basis. The 8875 sales tax rate in Long Island City consists of 4 New York state sales tax.

Long Island residents pay some of the highest property taxes in the country and Nassau County is one of the only counties where the average property tax amount is over 10000 according to a new. This is the total of state county and city sales tax rates. Before the official 2022 New York income tax rates are released provisional 2022 tax rates are based on New Yorks 2021 income tax brackets.

Assessment Challenge Forms Instructions. This way you wont have to expect separate taxes for property and school taxes. ZIP code 11003.

TAX MIL RATE PER 1000 base budget 8035 8392 44 Town of Long Island Tax Rate Computation Approved Budget FY2021-22 Proposed Budget FY2022-23 Change FY22 to FY23 Tax Rate Computation. 35 lower than the maximum sales tax in KS The 7 sales tax rate in Long Island consists of 65 Kansas state sales tax and 05 Phillips County sales tax. The median property tax bill in Suffolk County tends to be right around 9500.

Finally a firm that gives you the individual attention that you deserve. Lower Property Taxes In Suffolk and Nassau New York Call Heller Tax Grievance for a Free tax grievance application.

Remember That You Don T Actually Own Your Property Try Not Paying Your Real Estate Taxes And See Who Comes To Auction Off Their Pr Property Tax Estate Tax Tax

Property Taxes By State County Lowest Property Taxes In The Us Mapped

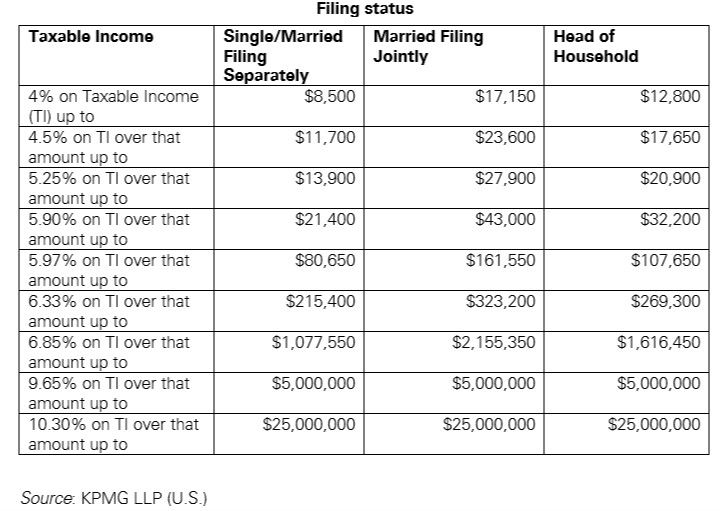

Us New York Implements New Tax Rates Kpmg Global

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Pennsylvania Sales Tax Small Business Guide Truic

State Income Tax Rates Highest Lowest 2021 Changes

When Looking At A New Market Don T Neglect These Numbers Marketing Investing Property Tax

Tax Information City Of Katy Tx

Blutter Blutter 516 433 7777 497 S Oyster Bay Rd Plainview Ny 11803 516 433 7777 Www Blutter Com Https Plus G Tax Attorney Attorney At Law Attorneys

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Irs Filing Taxes

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

The Independent Contractor Tax Rate Breaking It Down Benzinga

County Surcharge On General Excise And Use Tax Department Of Taxation

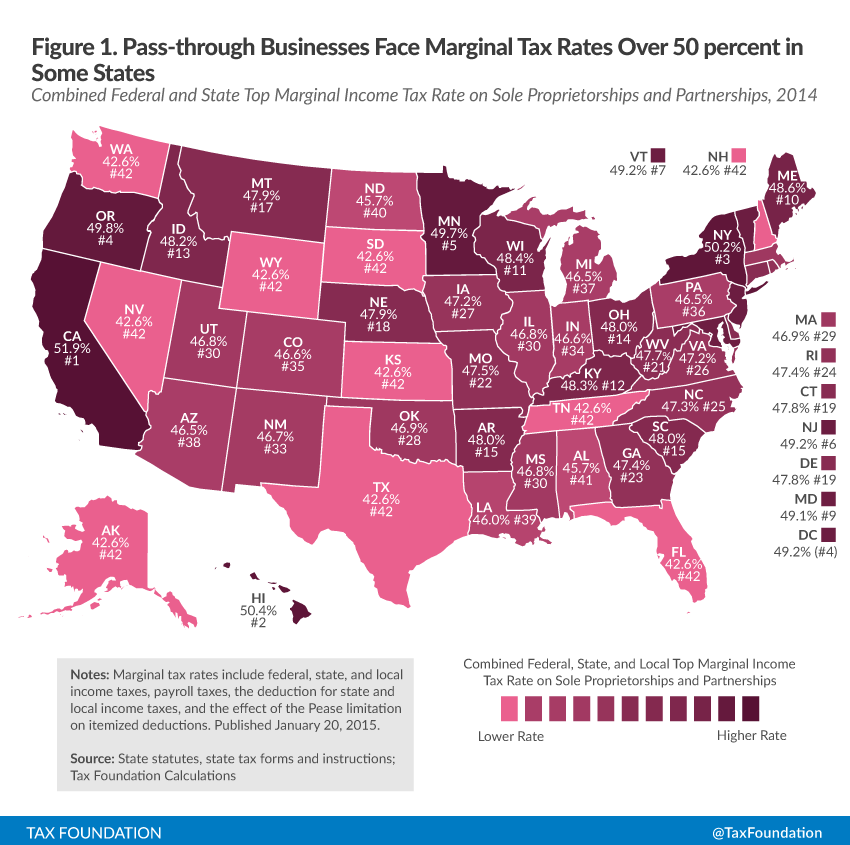

An Overview Of Pass Through Businesses In The United States Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation